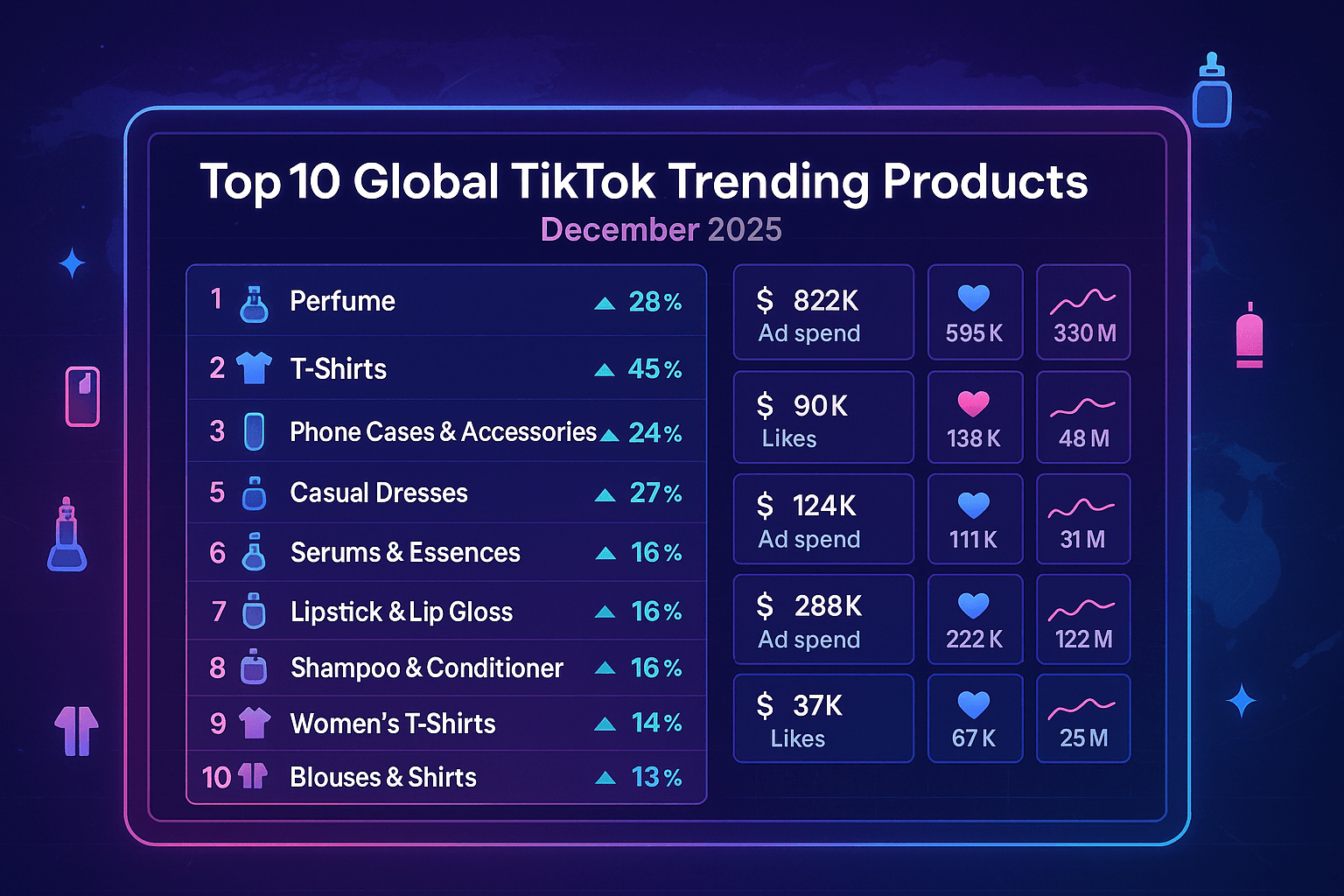

2. Global Top 10 Trending TikTok Products in December 2025

December 2025 produced one of the strongest, clearest global trend patterns we have

seen on TikTok. Across all regions, product categories that offered

high giftability, visual appeal, emotional storytelling potential, and low cost-per-adoption

dominated. The TikTok Creative Center data shows a blend of beauty, fashion,

accessories, and lifestyle essentials leading the global rankings.

Below is a breakdown of the top 10 categories ranked by global popularity,

along with key performance signals such as CTR, CVR, CPA, and total impressions.

2.1 Global Top 10 Categories

(By Popularity)

- Perfume (Popularity: 28K | +27%)

One of the most emotional and visually compelling product categories.

Fragrance ads and reviews surged due to holiday gifting, luxury aesthetics,

and ASMR-style content. - Men’s T-Shirts (25K | +45%)

Apparel went through a major December spike driven by holiday outfits,

winter layering content, and everyday wearable basics. - Phone Cases & Screen Protectors (24K | +44%)

A universally appealing category with exceptionally high conversion rates,

low CPA, and creator-friendly content formats. - Women’s Casual Dresses (17K | +27%)

Seasonal outfits, party dresses, and New Year transitions pushed this category

across fashion creators worldwide. - Women’s Trousers (16K | +30%)

High performance in nearly all regions due to winter styling, modest fashion trends,

and comfortable travel outfits. - Serums & Essences (16K | +25%)

Skincare remained powerful due to nighttime routines, GRWM,

and “winter hydration” content cycles. - Lipstick & Lip Gloss (16K | +23%)

High-engagement beauty content paired with Christmas party makeup tutorials. - Shampoo & Conditioner (15K | +28%)

A category boosted by repair-focused winter haircare and affordable beauty routines. - Women’s T-Shirts (14K | +42%)

Versatile styling videos, minimal-style creators, and basic tees for holiday travel. - Women’s Blouses & Shirts (13K | +40%)

Lightweight festive outfits and workplace holiday events drove widespread demand.

These categories share a common trait:

they appear naturally in everyday creator content, making them easy to demonstrate, easy to review, and easy to sell.

2.2 Why These Categories Won December

- High visual payoff: Fashion, beauty, and accessories fit perfectly into short-form storytelling.

- Strong gifting season: Perfumes, lip gloss sets, and apparel thrive before Christmas and New Year.

- Low barrier to purchase: Affordable items like skincare and phone cases convert quickly.

- Creator amplification: UGC creators posted thousands of product demos, styling videos, and “What I bought for Christmas” content.

The result was a December ecosystem where products with both aesthetic value + functional value achieved the highest viral velocity.

3. Regional Performance Patterns Behind December’s Top Products

While the global leaderboard captures broad consumer behavior,

TikTok’s product trends become significantly more interesting when viewed

at the regional level. Each market shows its own purchasing style,

creator ecosystem, and cultural triggers, giving December 2025 a

highly multi-dimensional trend landscape.

Below is a detailed breakdown of how products performed

across Southeast Asia, the Middle East, North America, Europe, and Latin America.

All insights are based on real December TikTok Creative Center data.

3.1 Southeast Asia: Fast Fashion + Phone Accessories Dominate

Countries like Indonesia, Thailand, Vietnam, and the Philippines showed

a strong bias toward affordable apparel, beauty products, and mobile accessories.

- Men’s T-Shirts and Dress Shirts remained top sellers

due to high frequency of fashion-haul content. - Phone cases had some of the highest conversion rates

across all markets, often exceeding 15–20% CVR. - Serums, lip gloss, and haircare performed well because of GRWM culture.

Southeast Asia remains TikTok’s most volume-driven commerce region,

with low CPA costs and massive impression pools making it an ideal market for

scale-oriented sellers.

3.2 Middle East: Perfume + Premium Basics

Saudi Arabia and the UAE consistently rank fragrance as a top category.

December 2025 was no exception.

- Perfume saw popularity increases of +51% in Saudi Arabia

and +69% in the UAE. - Frames & glasses also saw massive growth (+64% UAE, +100% KSA).

- Haircare products such as treatments and conditioners

became top performers due to winter dryness.

Middle Eastern consumers engage heavily with aesthetic, luxury,

and self-care product videos, making December a peak month

for premium-category conversions.

3.3 Western Markets (US, UK): Beauty + Occasionwear + Seasonal Gifts

Western markets demonstrated a balanced mix of beauty and apparel.

The stronger emphasis on gift-oriented categories

differentiates these markets from Asia.

- Perfume remained top-ranked due to Christmas gifting.

- Dresses, jackets, and sweaters surged in the UK.

- Lip gloss and serums performed exceptionally well in the US.

- “Holiday glam” makeup kits drove strong engagement.

Unlike Southeast Asia, Western audiences respond strongly to seasonal styling content, holiday makeup, and emotional gifting stories.

3.4 Latin America: Beauty + Tech + Seasonal Lifestyle

Mexico and Brazil showed a blend of fashion, beauty, and consumer tech.

- Phone cases consistently appeared in top-performing spots.

- Lipsticks and serums surged due to beauty influencer crossovers.

- Hair dye and haircare products experienced seasonal spikes.

- Lifestyle items such as puzzles and small electronics also gained traction.

These markets thrive on creator-driven authenticity and household-oriented shopping patterns.

4. Why Perfume Became the NO.1 Global TikTok Product in December 2025

Perfume was the clear winner of December 2025, leading with 28K global popularity score, +27% growth, over 595K likes, and more than 330 million impressions. This surge is not random—TikTok is uniquely suited for fragrance marketing because scent-related content blends emotion, storytelling, gifting psychology, and aesthetic visuals.

4.1 The Gifting Effect

Perfume is a top-tier holiday gift across regions. In December,

creators produced thousands of videos such as:

- “Perfumes I’m gifting this year”

- “Top winter fragrances under $20”

- “What perfume matches your vibe?”

- “Date night scents for December”

TikTok amplifies this format because it delivers:

high shareability, high save rates, and strong comment engagement,

driving products to widespread virality.

4.2 Visual Creativity Drives CTR

Perfume content typically includes:

- Slow-motion spritz clips

- Glass bottle close-ups

- Mood-board style edits

- ASMR packaging sounds

This aesthetic style produces consistently high CTR due to

visual richness + emotional resonance—a combination that other product categories

struggle to match.

4.3 High Emotional Impact

Perfume carries social meaning: confidence, romance, mood, identity.

These elements align perfectly with TikTok’s culture of expressive storytelling.

December’s emotional context amplifies that effect even further.

4.4 Regional Reinforcement

- Middle East: Perfume is culturally dominant and heavily gifted.

- Southeast Asia: Affordable fragrance dupes trend every December.

- Western markets: Luxury fragrance holiday sets perform extremely well.

When multiple regions push the same category simultaneously,

TikTok’s algorithm reinforces the trend at the global level.

4.5 Prediction: Will Perfume Stay NO.1 in January?

Perfume typically drops after holiday gifting, but January may still show

strong performance for:

- “New-year-new-scent” content

- Luxury Hauls

- Winter fragrance recommendations

However, it is unlikely to remain the global NO.1 as other categories like skincare and apparel regain dominance in Q1.

5. Apparel Surge: T-Shirts, Dresses & Seasonal Outfits

Apparel was the strongest multi-region performer in December 2025, second only to perfume.

TikTok’s fashion ecosystem thrives during December because travel outfits,

Christmas parties, gift guides, and New Year transitions create

a massive demand for outfit content. This aligns perfectly with

algorithmic patterns that reward visually appealing transformations and relatable styling videos.

TikTok Creative Center data across markets reveals that

T-shirts, casual dresses, trousers, blouses, party outfits, and men’s shirts

surged dramatically during the month. These categories dominated the charts because they offer:

- Instant visual payoff in short-form video formats.

- High shareability through styling, transitions, and outfit-of-the-day formats.

- Low purchase friction due to affordable pricing and high availability.

- Cross-niche compatibility with beauty, lifestyle, travel, and daily vlog creators.

5.1 Global Apparel Leaders

- Men’s T-Shirts – 25K popularity (+45%)

Dominant across Indonesia, Thailand, Philippines, Mexico, and the US.

High CTR (3–5%) and low CPA made this one of the most scalable categories of December. - Women’s Casual Dresses – 17K popularity (+27%)

Driven by holiday events, party aesthetics, and “Christmas lookbook” content. - Women’s T-Shirts – 14K popularity (+42%)

Popular due to airport outfits, minimalist styling, and winter travel content. - Women’s Blouses & Shirts – 13K popularity (+40%)

Favored in Europe and Southeast Asia due to workplace holiday outfits and family celebrations. - Trousers & Jeans – 16K popularity (+30%)

Consistently strong across Southeast Asia due to modest fashion content and daily styling videos.

5.2 Regional Apparel Highlights

Southeast Asia (Indonesia, Thailand, Vietnam, Philippines)

The region displayed exceptionally high apparel volume. Trends were influenced by:

- Affordable fashion hauls

- University outfit inspiration

- Travel outfits during holiday season

- Minimalist capsule wardrobe creators

Western Markets (US & UK)

Apparel content centered around:

- Christmas party dresses

- Winter outerwear (coats, sweaters)

- New Year’s Eve outfits

Middle East (Saudi Arabia & UAE)

Modest fashion, abayas, layered looks, and premium seasonal outfits drove December engagement.

5.3 Why Apparel Converts So Well on TikTok

- High storytelling value: clothing fits naturally into daily-life content.

- Strong role in creator identity: fashion creators push trends quickly.

- Low return anxiety: budgets allow impulse purchases.

- Size flexibility & universal use: T-shirts and dresses are evergreen staples.

Apparel’s December performance indicates that creative demonstration + emotional storytelling remains one of TikTok’s strongest conversion engines.

6. Beauty Products

High Conversion Rates & Emotional Storytelling

Beauty categories—including serums, lip gloss, lipsticks, skin mists, moisturizers, and haircare— consistently delivered some of the highest conversion rates in TikTok commerce. December 2025 amplified this trend due to winter dryness, holiday makeup looks, and creator-led GRWM (Get Ready With Me) content.

TikTok Creative Center data across multiple regions shows that beauty remains one of the strongest product verticals due to close-up visuals, high trust-building potential, strong social proof, and repeat purchase behavior.

6.1 Key Beauty Categories That Exploded in December

- Serums & Essences – 16K popularity (+25%)

Fueled by winter skincare routines, creator transformations, and 2025 skin repair trends. - Lipstick & Lip Gloss – 16K popularity (+23%)

Surged across US, UK, Latin America due to holiday glam, soft makeup routines,

and “top 5 lip combos” content. - Shampoo & Conditioner – 15K popularity (+28%)

Particularly strong in Southeast Asia and the Middle East due to seasonal dryness and

hair repair content. - Hair & Scalp Treatments – +56% growth in KSA

Regional climate + high creator adoption pushed this category forward in the Middle East. - Beauty Supplements & Mixers – Thailand PH Vietnam

Youth-driven beauty culture + UGC review format created a strong demand spike.

6.2 Why Beauty Converts Better Than Most Categories

Beauty categories outperform because they activate multiple psychological drivers:

- Social proof: creators show visible before/after results.

- Emotional resonance: beauty routines feel intimate and personal.

- High retention formats: skincare & makeup videos hold viewer attention longer.

- Fast product demonstration: viewers understand how the product works quickly.

December further boosts beauty conversions because audiences seek:

- Holiday event makeup

- Giftable beauty bundles

- Year-end self-care improvements

- Winter repair & hydration routines

6.3 Regional Behaviors That Strengthened Beauty

Southeast Asia:

GRWM and “aesthetic morning routine” culture drives high engagement.

Middle East:

Perfume, haircare, and luxury skincare dominate gifting content.

Western markets:

Holiday glam + winter skin hydration themes thrive.

Beauty remains a category where content formats align perfectly with TikTok’s algorithmic incentives, making December one of the most profitable months for sellers.

7. Phone Accessories: High CVR & Lowest CPA Category Globally

Among all December 2025 product categories,

phone accessories—especially phone cases and tempered glass screen protectors—

delivered the highest conversion rates (CVR) and lowest CPA across nearly every region.

TikTok Creative Center data shows extremely strong global performance:

- 24K popularity (+44%) globally

- 61 million impressions in the global dataset

- CVR exceeding 70% in some markets

- CPA often between $0.10–$0.50

No other product category in December delivered such a consistent blend of high volume, low cost, and strong conversion velocity.

7.1 Why Phone Accessories Perform So Well

- Universal demand: nearly every user owns a smartphone.

- Low price → impulse-buy behavior: ideal for short-form commerce.

- High visual appeal: creators showcase colorways, designs, transitions, etc.

- Easy to demonstrate: simple unboxing and installation content goes viral quickly.

- Frequent creator collaboration: many micro-creators push aesthetic case trends.

7.2 Regional Insights

Southeast Asia: One of the biggest markets due to low CPA and high TikTok Shop adoption.

Latin America: Strong engagement driven by personalization trends (glitter cases, anime cases, reflective cases).

Western Markets: Holiday-themed phone cases (“Christmas edition”) saw seasonal spikes.

7.3 Best Performing Formats for December

- Quick-change case transitions

- Aesthetic mirror shots

- “Phone case collection” videos

- ASMR-style unboxing

- Drop-test or screen-protector demos

Phone accessories will likely remain a top-performing category going into 2026 due to low product complexity, high creator adoption, and universal appeal.

8. Household & Lifestyle Products Rising Unexpectedly

While beauty and apparel typically dominate TikTok shopping in December, the 2025 dataset revealed a surprising secondary trend: household and small lifestyle items surged across multiple regions. Categories like household cleaners, puzzles, tumblers, earphones, and everyday-use accessories appeared repeatedly in the top 15 trending products—especially in the Middle East, Brazil, Mexico, and select Southeast Asian markets.

This shift reflects an evolution in TikTok commerce behavior. Audiences are no longer responding only to beauty hauls or fashion content; they are increasingly influenced by practical recommendations, home-organizing videos, lifestyle upgrades, and creator routines. December’s seasonal context amplifies this effect.

8.1 Key Household & Lifestyle Categories That Spiked

- Household Cleaners – Saudi Arabia (+67% popularity)

December home preparation, deep-cleaning routines, and aesthetic “reset” videos boosted this unexpected category. - Puzzles & Indoor Games – Mexico & Brazil (+35% to +50%)

Family gatherings, holiday bonding, and indoor entertainment trends contributed to the rise. - Stainless Steel Tumblers & Drinkware – US & UK

Influenced by cozy winter content and “hydration challenge” creators. - Earphones / Headphones – Brazil & SEA Markets

Low-cost tech accessories gained traction due to gifting and travel season.

8.2 Why These Categories Grew Faster Than Expected

Household and lifestyle items are benefiting from

three major behavioral shifts on TikTok:

- Daily routine content is becoming viral capable.

Room resets, home cleaning, cozy lifestyle vlogs, and “Sunday prep” videos all use

practical products that viewers easily adopt. - Affordable lifestyle upgrades convert extremely well.

Items priced under $20–$40 see high impulse-buy volume during holiday season. - Creators are diversifying.

Beauty creators now incorporate lifestyle routines, increasing visibility for

non-beauty items like organizers, tumblers, and cleaners.

8.3 Cultural Context Behind the Spike

- Middle East:

Pre-New Year home cleaning traditions and gifting culture elevated household cleaners. - Latin America:

Family-oriented seasonal behavior increased demand for puzzles, games, and lifestyle items. - Western Markets:

“Cozy content” and productivity themes lifted home drinkware and indoor lifestyle accessories. - Southeast Asia:

Affordable tech and home accessories thrive due to practical gifting.

Although these categories are less “aesthetic” than beauty or fashion, they convert well because they solve everyday problems and appear in highly relatable content formats.

9. What These December Trends Mean for Marketers & TikTok Sellers

The December 2025 product landscape offers marketers, sellers, and creators a clear roadmap for how to position products on TikTok during peak shopping seasons. The platform’s commerce behavior has shifted far beyond traditional “beauty-only” trends. Today, multi-category momentum drives discovery and purchase.

Here are the most important insights extracted from real TikTok Creative Center data.

9.1 High-Impression Products Are No Longer the Only Winners

In 2025’s December data, some top performers (like phone accessories and shampoo) had significantly lower cost-per-acquisition despite modest impressions. This indicates a shift toward conversion-first product virality, not impression-first.

Sellers should prioritize:

- Low-priced, functional items

- Products with visually satisfying demos

- Skincare and haircare that solves seasonal problems

- Fashion basics that are easy to style

9.2 Cross-Region Trends Are Stronger Than Ever

Perfume, phone cases, basic apparel, and skincare appeared in every region’s top charts, meaning these categories are globally scalable for sellers and creators.

- Southeast Asia: fashion + accessories dominance

- KSA & UAE: fragrance, haircare, premium basics

- US & UK: beauty + seasonal outfits

- Mexico & Brazil: tech + low-cost beauty

Sellers planning 2026 expansions should target multi-region compatible items rather than ultra-niche products.

9.3 Creator-Led Demonstrations Are Now Mandatory

TikTok’s algorithm in 2025 strongly favored:

- Face-forward demonstrations

- Before/after visuals

- Step-by-step tutorials

- Aesthetic storytelling

Creators are now the main driver of product adoption, and videos with UGC-style authenticity outperform polished commercial content.

9.4 Seasonal Timing Matters More Than Category

December product trends follow predictable emotional cycles:

- Weeks 1–2: skincare, haircare, cozy lifestyle

- Week 3: party outfits, makeup, fragrances

- Week 4: New Year optimization, transformations, self-care

Brands that aligned their creatives with these emotional windows saw significantly higher conversion rates.

9.5 Short-Form SEO Is Now Part of TikTok Commerce

TikTok’s 2025 update boosted the importance of:

- Keyword-rich captions

- Product-driven hashtags

- Clear category descriptors

Products with stronger TikTok SEO visibility trended more consistently across multiple regions—even when creator adoption was moderate.

10. Why Engagement Levels Decide Product Success on TikTok in December

TikTok’s December 2025 product trends confirm a pattern marketers have observed all year:

products with early engagement velocity gain disproportionate reach and higher conversion rates. In December—where competition peaks and scrolling behavior intensifies—this effect becomes even stronger.

10.1 Engagement Signals TikTok Prioritizes During December

- View velocity: how quickly a video accumulates views in the first 30–90 minutes.

- Watch time: the total percentage of the video users complete.

- Heart rate: likes per second in the first hour.

- Saves: one of the strongest product interest signals.

- Comments: especially “where to buy?” or “price?” comments.

- Shares: signals extreme relevance to social circles.

During December, TikTok’s algorithm tightens thresholds to manage the

massive spike in commercial content. As a result, videos that fail to reach

a certain engagement velocity often stall, while high-engagement videos receive

wider distribution across For You Pages.

10.2 The Engagement–Sales Flywheel

TikTok’s commerce dynamics form a loop:

- A creator posts a product demo.

- Early exposure → likes, comments, saves.

- Algorithm expands distribution.

- More viewers → more conversions.

- More conversions → more creators copy the trend.

- The product becomes a December viral item.

This explains why categories like perfume, T-shirts, cases, and skincare

exploded globally—creators amplified each other, and the algorithm responded.

10.3 Why Engagement Matters More in December Than Any Other Month

- Holiday competition: thousands of brands advertise heavily.

- Higher user activity: scroll time increases significantly.

- Shorter trend cycles: products trend faster but expire quicker.

- Stronger FYP filtering: TikTok pushes only the highest-engagement videos.

The combination of high demand and high competition makes engagement the decisive factor in whether a product goes viral or disappears under holiday noise.

10.4 Why Creators Must Strengthen Engagement Signals Before Promotion

December’s algorithm rewards creators who:

- optimize watch time with faster hooks

- post more frequently

- use trending sound formats strategically

- test multiple versions of the same product video

- introduce storytelling rather than basic reviews

Brands and creators who fail to generate strong engagement early often see reduced reach, even if the product category is trending globally.

This sets up the next logical phase in your funnel: December’s performance optimization strategies—which will be covered in the Christmas Shopping Performance blog (BOFU).

11. January 2026 Forecast: What Happens After December’s Trend Explosion?

December is TikTok’s most commercially aggressive month, but the trends formed during the holiday cycle often reshape creator behavior and product demand in January. Based on TikTok Creative Center performance from December 2025, we can forecast which categories will continue trending, which will collapse, and which will transform into new early-year opportunities.

11.1 Categories Likely to Stay Strong in January 2026

Three categories show clear potential to maintain momentum because they align with:

- New Year habits

- Winter self-care

- Daily-use practicality

1. Skincare & Haircare

After December glamour, January shifts toward repair, hydration, and routine building. Serums, scalp care, moisturizers, and hair treatments will continue performing well—especially in

colder countries.

2. Phone Accessories

Because phone cases and screen protectors have universal demand and low CPA, they remain evergreen. The January spike in “organize your digital life” content will further strengthen this category.

3. Women’s & Men’s Apparel Basics

Trendy December outfits fade, but staple items—t-shirts, trousers, hoodies, and workwear—become the new focus as creators shift into “reset”, “routine”, and “back-to-work” themes.

11.2 Categories That May Decline After December

- Perfume — Most December virality is tied to gifting season and New Year parties. Demand will decrease as holiday emotion fades.

- Dresses & Partywear — Engagement drops quickly after New Year’s Eve content.

- Holiday Home Items — Seasonal spikes normalize.

11.3 Categories Likely to Rise in Early 2026

- Fitness apparel driven by New Year resolutions.

- Productivity & desk accessories supporting “back to routine” content.

- Self-care bundles linked to mental wellness and winter detox themes.

11.4 Creator Behavior Forecast

Creators will likely shift toward:

- Reset routines (“January reset”, “Sunday reset”)

- Minimalist wardrobe reorganization

- Affordable beauty routines replacing luxury holiday content

- Beginner-friendly tutorials for makeup, skincare, and fashion

- Tech upgrades (earphones, small electronics) for productivity

January rewards consistency over virality. The algorithm tends to stabilize, making it easier for sellers to scale content-based performance strategies with lower CPMs and rising user intent.

12. December’s Data Shapes 2026 Product Strategy

December 2025 was a defining moment for TikTok commerce. The platform showed unprecedented clarity in what types of products succeed, how creators influence purchasing, and how regional differences shape global trends. By analyzing TikTok Creative Center’s real metrics, we see that product success is no longer driven only by aesthetics or novelty—it depends on emotional storytelling, daily use relevance, algorithmic timing, and creator amplification.

Perfume dominated because of gifting psychology. Apparel surged because of seasonal styling and everyday practicality. Skincare thrived on emotional trust and routine-driven content. Phone accessories reached some of the highest conversion rates globally because they are simple, universal, and visually easy to demonstrate.

Beyond these categories, lifestyle products, puzzles, tech accessories, and home staples appeared consistently across regions—indicating that TikTok’s shift toward authentic daily-life content has permanently expanded what can “go viral.”

For marketers, creators, and sellers entering 2026, the roadmap is clear:

- Lean into creator-led demonstrations instead of polished ads.

- Prioritize low-friction, visually expressive products.

- Target categories with cross-region universality.

- Follow seasonal emotional cycles to time your content.

- Use TikTok SEO (keywords, descriptors, captions) as aggressively as visuals.

- Get early algorithmic trigger signals by real TikTok views growth tools.

December’s insights don’t just describe what happened—they foreshadow what will shape TikTok commerce for the next year. Sellers who understand how trends emerge and how creators accelerate purchasing will enter 2026 with a significant advantage.