Followers as a Trust Signal for Luxury Brands

In the Gulf, followers are more than vanity — they’re a brand suitability signal. Agencies and luxury advertisers look for GCC audience composition, not random global numbers. A base of Saudi and Emirati followers tells partners you’re relevant, reliable, and ready for premium campaigns.

Why local followers matter

- Brand due diligence — KSA/UAE brands check audience geo, age, and language before deals.

- Algorithm relevance — more GCC followers = more delivery on local For You pages.

- Buyer power — GCC has high AOV for beauty, fashion, tech, hospitality, F&B, and events.

Creator Playbook (GCC)

- Use bilingual bios (Arabic + English) and location cues (e.g., Riyadh, Dubai, Doha).

- Mix content pillars: luxury lifestyle, mall/product demos, café culture, travel, modest fashion, tech unboxings.

- Feature regional moments (National Days, Ramadan/Eid, school return, shopping festivals).

Build a Saudi follower base to pass brand checks and unlock premium partnerships.

Views That Amplify Arabic + English Content

GCC feeds are bilingual: Arabic (Gulf/Khaliji + MSA) and English for expats. Videos that earn targeted views in both languages rank more consistently and attract broader sponsorships.

Format & language tips

- Dual captions — Arabic on-screen text (RTL) + concise English subtitle line.

- Audio cues — Gulf pop/Khaleeji beats for local resonance; global hits for expat reach.

- Snackable edits — 10–20s for product/venue reveals; 20–40s for stories & tutorials.

Posting windows to test

- Evenings (post-work/school) and late night scrolling.

- Weekend prime (Thu–Sun across GCC markets).

- Ramadan — late nights and pre-Suhoor spikes; Eid shopping surges.

Boost UAE-targeted views to reach both Arabic speakers and expats in one of the GCC’s most brand-active hubs.

Likes & Comments That Attract Partnerships

Likes are quick validation; comments are the credibility check. GCC brands read your threads for tone, respectfulness, and authenticity. Clean, positive conversations (without spam) are a green light for paid work.

How to engineer quality engagement

- Ask tasteful questions — “Which mall café is your favorite in Riyadh?” or “Dubai folks: weekend plan ideas?”

- Respectful humor — keep it friendly; avoid sarcasm that can be misread cross-culturally.

- Pin best comments — highlight helpful tips, venue names, product shades, price/fit notes.

Strengthen social proof with Qatar-based likes and spark Kuwait-targeted comments that brands trust.

Livestreams Driving E-Commerce in GCC

TikTok Live is growing quickly across Saudi and UAE — especially for beauty, modest fashion, gadgets, restaurants, and attractions. Lives combine discovery with conversion: long watch time + real-time Q&A + promo codes = sales.

Live formats that work

- Shop-along — live try-ons or unboxings with product links and time-boxed offers.

- Venue tours — cafés, malls, pop-ups; ask viewers where to go next.

- Event & travel — concerts, sports, staycations, attractions (family-friendly focus).

Retention & culture notes

- Use bilingual hooks and on-screen prompts to help mute viewers.

- Schedule lives outside prayer windows; add a respectful note if timing overlaps.

- Promote codes in Arabic numerals and English; show prices clearly.

Grow Bahrain-focused livestream fans to increase watch time and Shop conversions across the Gulf.

Content & Creative That Fit Gulf Culture

Premium growth means brand-safe creative: stylish, upbeat, and respectful. Think malls & cafés, family activities, travel, tech, fitness, skincare, perfumes, abaya/modest fashion, men’s grooming, car culture, gaming & e-sports.

Creative guardrails

- Modesty — avoid provocative visuals; keep fashion showcases tasteful.

- Positivity — avoid politics and cultural criticism; focus on utility and lifestyle.

- Accuracy — be clear on prices, places, and disclaimers (e.g., “available in Dubai Mall branch”).

Respecting these norms raises your “brand suitability” score and improves close rates with agencies.

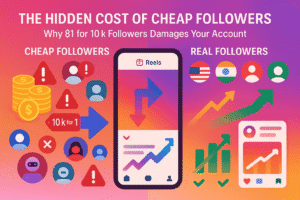

Avoiding Cheap Growth That Hurts Reputation

GCC brands run audits. They’ll catch low-quality tactics instantly: non-GCC followers, emoji-spam comments, or sudden spikes with poor retention. Cheap growth risks shadow reach, lost deals, and long recovery.

Audit triggers to avoid

- Off-region audience — followers/likes from non-GCC countries.

- Low retention — high views but 1–2s average watch time.

- Comment quality — repeated emojis, irrelevant language, copy-paste phrases.

Premium alternative

- Order country-specific engagement (KSA, UAE, Qatar, Kuwait, Bahrain, Oman).

- Blend paid seed with organic posting & creator collabs in malls/events.

- Keep bilingual captions and local hashtags to maintain clean geo signals.

Add Oman-based shares to spark regional momentum without tripping brand-safety alarms.

Calendar, Trends & Measurement (GCC)

Operate on a simple, scalable system — then layer premium signals.

Calendar anchors

- Ramadan & Eid — late-night lives, gift guides, family venues, modest fashion.

- National Days & city seasons — KSA’s Riyadh Season, Dubai Shopping Festival, F1 Abu Dhabi, concerts.

- Weekend peaks — test Thu–Sun prime and late evenings.

Track like a pro

- Hook rate (3s/plays), avg watch time, and shares/1,000 views.

- Comment velocity (first 30–60 minutes).

- Live watch time, CTR on promo codes, TikTok Shop conversions.

When a format beats your 2-week average, create 3–4 variations and support with a light layer of country-matched engagement to cement momentum.

Conclusion

Play the Premium Game

Arabia rewards creators who feel relevant, respectful, and reliable. Build a follower base in the Gulf, stack real views/likes, cultivate positive comment threads, and run shoppable livestreams. That’s how you move from creator to brand partner in KSA, UAE, and across the GCC.

Activate the full targeted TikTok framework and scale your GCC strategy into other regions.